Growth is a challenge for any business, and B2Bs makes no exception. The lifetime value of a customer (or CLTV) is an essential element of growth for any B2B SaaS company. Once a customer has been acquired, it is far easier and cheaper to retain them than replace them.

In addition, existing customers spend 67 percent more than new customers. So you have a lower chance of selling to a new customer who spends less, and they may also cost up to 5x more to acquire.

However, despite this evidence, we can’t seem to get away from our “first love”: customer acquisition. Don’t get me wrong; acquisition is important for obvious reasons. You can’t retain customers you don’t have or customers who aren’t the right fit.

Unfortunately, acquisition is where companies end up putting most of their focus. Nearly half of companies put an emphasis on acquisition, and nearly 20 percent of companies don’t measure their CLTV, and only 15 percent use it properly.

Knowing your CLTV is important on so many levels. The value of your customers drives how much you can afford to spend to acquire them. You certainly don’t want the expense to acquire them and revenue they bring in to be disproportionate. Keeping a customer, hence increasing their lifetime value, translates to increased sales at a lower cost to you.

A focus on CLTV also means a focus on making customers happy. Happy customers not only spend more money with you — increasing your CLTV — they also tell people about you. Their word-of-mouth influences 91 percent of B2B purchases and generates 2x more sales than paid ads — and it doesn’t cost you a dime.

And the reality is that 25 percent of users abandon a tool after the first use! That means that businesses are having to make up the difference of churn with acquiring more customers. This is expensive and time-consuming — especially for B2B companies where the sales cycle is longer.

Therefore, you must plunge to acknowledging the lifetime value of a customer and seek ways to improve it – and together with it, retention. How long are your customers sticking around, and how much are they spending?

Managing CLTV can be a challenge because everyone has a responsibility for it. That is product, sales, marketing, customer support, technology, operations, and most other teams you have.

Thankfully, it is not that hard to learn and improve it! We’ll introduce you to five best practices to increase your CLTV so that you can see increased revenue and decreased expenses.

Do you know what your CLTV is??

Let’s understand a bit the basics of CLTV, though, before digging into the solution.

Note: Want to boost your product's user experience by analyzing account behavior and patterns? Try Leadfeeder's 14-day trial.

CLTV is the key focus area you have been neglecting

Here’s how to calculate the CLTV of your customers:

Average revenue per user (ARPU) = total revenue/ number of customers [in a given time]. If the given time is a month, multiply by 12 months to get their value in a year. Then, determine how long you anticipate being able to keep a customer around, and you have their CLTV.

Alternatively, you could calculate your CLTV this way:

Average revenue / # customers in a cohort (ex. Jan 2019 - Jan 2020 customers)

This method averages out revenue over time, compensating for slower months.

Amazon Prime discovered their subscription members had a much higher CLTV. Prime members spent $1340/yr. in 2013 vs. non-Prime members who averaged $650/yr.

Netflix noted that their subscribers stuck around for 25 months while waiting for DVDs to come out. So, they maximized that, and users ended up spending $291.25.

The metrics are also not easy wins, like acquisition metrics are. The lifetime value of a customer has to be measured over a long period of time. It requires a lot of patience and knowledge of customers.

Since we established CLTV is so valuable and how to calculate it, here are some best practices for increasing it.

Best practice #1: Provide a world-class onboarding experience

Customers get their very first taste of your product through your onboarding experience.

The onboarding experience is crucial to customer success. Post-sign up, 40-60 percent of customers don’t even end up using a product. The onboarding experience must give people enough of a taste to get past the trial and sign up for a recurring subscription.

Map out an onboarding process that identifies which points are crucial for your users to hit. Challenge yourself to articulate why they must hit each of those points. The easier the path, the better. But, no skipping important steps!

Wes Bush, the founder of Product-Led Institute, has a great suggestion. He says to think of your onboarding process as a bowling alley. The pins at the end of the lane are the goal you want your customers to reach. What must they do to reach that end benefit?

The bumpers to either side of the lane are a conversational bumper and a product bumper. The conversational bumper includes key conversational touchpoints (automated or manual). The product bumper could be an in-app tour or tips.

Users should be able to experience the benefits of your product as soon as possible. The longer the onboarding time, the more frustrated users get. Unhappy users leave.

Marketing automation tools like Marketo or ActiveCampaign can help you give tips at the right moment in your onboarding process, and in general, in the customer’s journey. Be proactive in providing the information a customer needs to experience your product. This decreases churn and increase its CLTV.

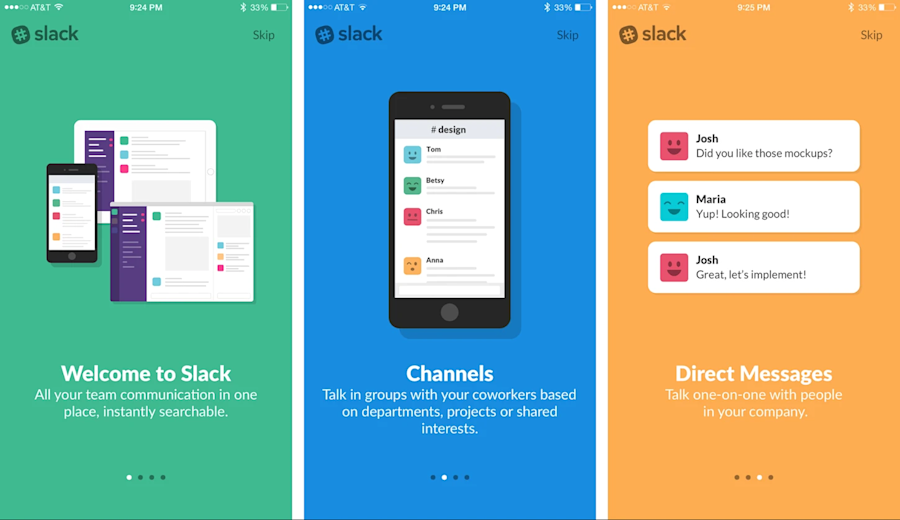

Take a look at Slack’s onboarding process. It is so simple, yet it gives everything a user needs to know! Users love it.

Best practice #2: Help your B2B customers achieve success

Customer success was neglected for a long time. But, now it is gaining traction with B2B SaaS companies. The idea helps companies define what success looks like for their customers and how they will help their customers achieve it, following onboarding.

If you don’t get the benefits you were sold on, would you keep using a tool much less pay for it? A customer should reach and experience the benefits they wanted from your product in the first place in order to increase their customer lifetime value.

This is a long-term process that requires you to “... be focused on your customer first and your company second. Customer success must be defined by the extent of value your solution provides to your customers. The higher that value is, the greater your ability will be to see significant monetary and non-monetary returns,” says Boaz Maor, a customer success advisor.

McKinsey identifies five key business areas that make up the customer success framework:

A unified go-to market strategy that features a charter for customer success.

A sustainable funding model, built on top of the intrinsic value brought by customer success activities.

Customer-success talent engines or the right capabilities and management to oversee customer journeys.

Advanced analytics for predictive analysis and change management flows.

Customer success mentality as part of the organizational culture.

Enterprise IoT company Software AG found that in order to enhance customer success, it would have to improve multiple of its touchpoints and systems. Their journey towards customer success included:

Updating and unifying their web-presence (250 different company sites were consolidated in a single platform),

Optimizing their disjointed customer journeys (using data-driven approaches to deliver more personalized experiences) and

Revamping their marketing and onboarding strategy (with the use of personalized campaigns and unique personas).

In the process, Software AG optimized all client touchpoints that could generate and hinder success and even created new roles in the organization that would support this new approach.

It’s important to understand the factors that contribute to success. And, conversely, the factors that inhibit success. User experience is so important now that more than two-thirds of companies use this as a differentiating factor. All too often, companies see what seems to be statistics showing great usage. But they don’t realize that customers are not experiencing the benefit that they had wanted. These customers will eventually churn.

Consider what success looks like for your customers. Then, identify what is standing in the way of their success. What can you do to remove those barriers?

Connect with your customers regularly. Use email, social media, text messages, and other methods. Share different types of content to spur them on to success. These could be demos, how-to guides, training sessions, case studies, user-generated content like reviews, or tips.

Want to put more focus on accounts that have more potential? Increase their CLTV by giving them high-touch, stellar support. As they achieve success and see benefits, make sure to talk to them about it!

Best practice #3: Include upselling and cross-selling

Working to increase your customers’ order value in the short term will increase their long-term value.

At this point, you’ve established trust with your customers. Companies know your name and your product delivers results. But, you aren’t building on that trust and selling supporting products or services. Every dollar left on the table with trusting customers means that you have to acquire new customers to compensate for churn.

Here’s a reason to be improving your product constantly: you can sell more when you have more to offer. Also, customers want you to meet their needs. They’ll have to go somewhere else if you don’t keep up with their needs. With more features and products, you can upsell and cross-sell when it seems to be a natural fit.

Cross-selling is recommending products that are complementary to what a user has already purchased. Or products that enhance the user’s experience of another product they are getting. It is most effective when it is personalized.

Upselling, on the other hand, is prompting a buyer to purchase a plan that costs more with more features or benefits than they had initially planned on purchasing. This will only work if the benefits are clear to the buyer, and the upsell isn’t more than 25 percent of the original order.

According to McKinsey, cross-selling can boost sales by 20 percent and profits by 30 percent. It’s important that cross-selling be personalized, though. That’s because personalized cross-sells account for 27 percent of revenue despite the fact that they only account for 7 percent of the site’s visitors. However, upselling is still 20x more effective than cross-selling.

The timing needs to be right for either to work. You want to make sure that you’ve hooked them and that they are getting a lot of value from what you are providing. If you jump the gun, it may seem like you disrespect them.

Good times to cross-sell or upsell would be:

after someone makes a purchase (either on the thank-you page or in a follow-up email);

on the checkout page;

in the shopping cart;

on the product page.

Try a post-purchase cross-sell to increase your CLTV. To do this, offer a limited-time discount on an item as a thank you for the recent purchase. An upsell could be sending them a coupon code or discount if they spend a certain amount of money within a defined time period.

Show different plans side by side on your product page. Like this, buyers have the option to choose the larger, more expensive plan with all of its added benefits.

Cross-selling and upselling yield best results when they are done in nurturing processes.

To effectively apply them in B2B, your sales strategy should focus on:

low-cost channel acquisition (via self-service);

nurturing through high conversion rate processes (via assisted sales).

Don’t build a wall between the two.

To maximize sales margins, you should acquire clients also through self-service (a.k.a. lower-cost channels). Not only due to the cost but also to respond to changing buyers’ needs. B2B purchasers prefer to learn independently, and they access digital channels during the buying process, meaning a self-service path may serve them well. Prospects discover your products via the website and sign-up for a demo/trial or perform a low-end purchase.

They will move down the funnel into the sales assisted part of the loop. That’s where you should identify nurturing potential and provide custom offers. Personalized upsells and cross-sells will ensure customer retention. Retention, being an upward path, should match the client growth rate. As a result, you need to be able to measure your client’s growth rate for using your product.

While getting a customer on self-service is a good starting point, upsells and cross-sells have the best conversion rate when they are done via human interaction. That is, the second part of your sales process should be assisted by a salesperson or account manager.

However, high conversion rates via assisted deals imply more costs and pressure on your sales team. This is why, after having taken clients to the sales assisted area and increased their value, you need to move them back in self-service.

This whole cycle should happen in an omnichannel environment. B2B in omnichannel removes friction and minimizes the churn rate that would otherwise occur when shifting prospects from channel to channel in the multichannel approach.

Adobe and Corel are great at cross-selling and upselling, as can be seen from the examples below.

When a user went to purchase Adobe’s InDesign and was on the checkout page, Adobe cross-sold them by prompting them with an option that was relevant to their success with InDesign: a plan to purchase stock images.

Corel attempted an upsell to their customer who was ordering VideoStudio to upgrade to the premium version of the product they were already in the middle of ordering.

Stop leaving money on the table! Your happy customers want more of you.

A great solution for using upsells and cross-sells for your business can come from your payment service provider. Professional commerce platforms like 2Checkout include rich features that allow you to effortlessly promote complementary or supplementary services to your users.

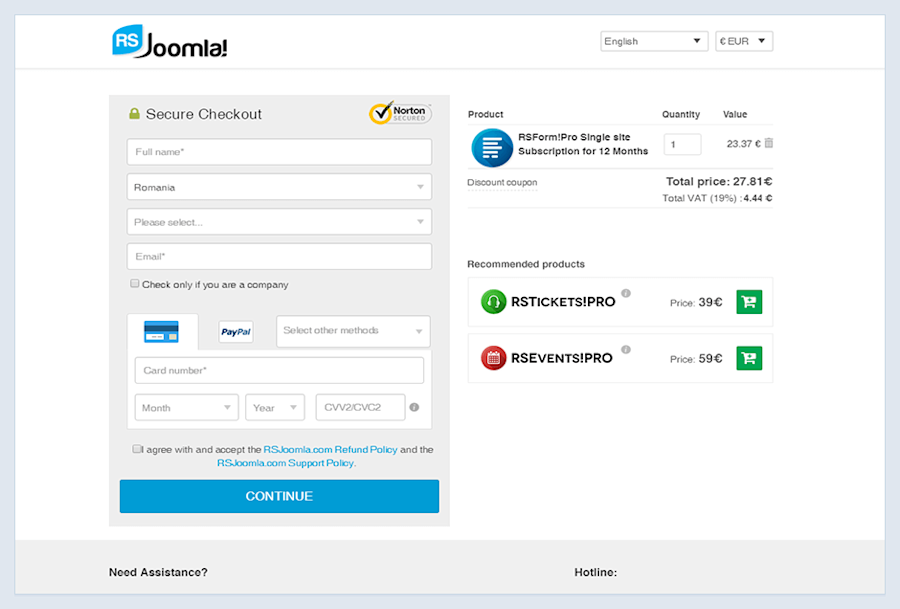

The example below illustrates a cross-sell supported by the eCommerce platform that the merchant is using.

Buyers are recommended with two additional extensions to enhance the main product (i.e., the form builder) – a help desk ticketing system and the event management solution.

Another example could be a B2B buyer looking to acquire document editing licenses. They can also be prompted with additional licenses and seats for storage or document archiving, ultimately generating a higher-order value.

Best practice #4: Improve renewal rates

Being able to depend on recurring revenue is fantastic. However, sometimes renewals don’t pan out. The customer could choose not to renew – we call this voluntary churn – or leaving may be unintentional – that’s involuntary churn.

Clearly, there are many reasons why customers choose not to renew. They aren’t getting the benefits they wanted, they don’t need or don’t use the product enough, or their card didn’t go through on the automatic renewal.

The key point is to find out why – and do something about it.

Not to despair, though! There are lots of different ways that you can improve renewal rates and increase your CLTV!

People are more likely to renew their subscription if they are happy and engaged. Keep them engaged all year by sending them timely emails with helpful tips, tricks, and highlights of their benefits.

Add an additional touchpoint around renewal time to remind them of your value. By notifying them of the upcoming renewal, you lower chargebacks and refunds requests.

Groove app, for example, found that a lot of its users were not sticking with their product.

By researching user behavior to identify Red Flag Metrics, however, the B2B company was able to uncover customers’ pain points and took redressive actions that reduced its voluntary churn rate by 71%.

Beyond user behavior, a whopping 16 percent of subscribers are lost for involuntary reasons at renewal time. You can easily do something about this via your payments provider.

As a quick reminder, subscriptions can be renewed through automatic or manual renewal.

Auto-renewals are convenient for users. That’s because they don’t risk forgetting to renew or risk losing data, settings, or account access.

Automated renewals may fail because of soft or hard declines. Soft declines on automated renewals may result from insufficient funds, an expired card, or a processing timeout failure. Hard declines include permanent authorization failures, account closure, or a credit card having been lost or stolen.

Luckily, there are tools out there that can help you curb involuntary churn on automatic renewals – your team may not employ these directly, but you should definitely be aware of them and request them from your provider. Some examples include:

Multi-Currency Management

Intelligent Payment Routing

Account Updater Services (external, internal)

Configurable Retry Logic

Dunning Management (for hard declines)

Using these tools consistently can bring revenue uplift of up to 20% on auto-renewals! Just ask for such revenue recovery tools to be activated for your account.

You are at an even greater risk of losing customers who renew their accounts manually.

Ideally, though, you would move customers from manual renewal to auto-renewal, because auto-renewals have 3x higher retention rates and higher authorization rates. Just remember that a little incentive can go a long way.

For those customers who are set up for manual renewal, send them regular reminders well in advance that their renewal time is approaching. Consider offering them a discount as a motivator for early renewal, and even a grace period if the renewal window passes.

Similar to auto-renewals, if the payment fails on manual renewals, send your customers automatic follow-ups with options for alternative payment methods, so the payment gets completed, similar to cart abandonment emails.

Best practice #5: Get personal

Deep relationships are paramount — especially in today’s day and age when everyone is stuck behind a screen. There’s something about feeling known that just warms the soul.

No one likes to lump in with the crowd. People want to be a name, not a number, but unfortunately, they end up getting reduced to a number more often than not. This is very much valid for business buyers, not just consumers. After all, they are people behind a company name!

You can learn so much from personal relationships, though. That knowledge helps ensure you deliver the right solutions.

Andy Mura, the head of marketing at Userlane, said it best, “Personalization plays a key role in modern transactions. The entire customer experience needs to be personalized, and users need to monitor their situation and the progress they’re making. Keep reminding users of all the milestones they covered at each step and what results they accomplished. Adoption reports and dashboards are useful to visualize achievements.”

So, show your customers you love them! Delight them!

Get to know your customers to learn what they need, and provide content to address those needs. Not only are your resources valuable, but they can also see that you are just plain old’ nice. Overdeliver. Go above and beyond.

Celebrating important life or in-app milestones will stay etched in their memory.

Maybe they got a promotion, or maybe they hit a success metric in your app. Little reminders of what they’ve achieved are a huge boost to the ego! People love feeling special and want to keep hanging out with the people who make them feel that way.

Dashboards or emails with progress reports are great ways to encourage your users and make them feel good.

Segment your users and take a look at how each persona uses your product. You can learn so much this way! Take this knowledge and create a unique nurturing strategy for each persona. This way, you can create a personalized experience that is still automated.

Conclusion

Your CLTV is paramount to your company’s growth.

But, statistics say that you are likely not putting enough emphasis on retention and CLTV. Consequently, you are having to make up for churn using a more costly method: acquisition.

Fortunately, retaining users and increasing the revenue each brings in isn’t that hard if you think about it in the right way.

Great onboarding experiences, intentional customer success initiatives, and personalization go a long way. Upselling, cross-selling, and improving renewal rates are also mechanisms well within reach to implement and start seeing an increase in CLTV.

What will you do to increase the lifetime value of your customers?

Note: Want to boost your product's user experience by analyzing account behavior and patterns? Try Leadfeeder's 14-day trial.

Now that you're here

Leadfeeder is a tool that shows you companies that visit your website. Leadfeeder generates new leads, offers insight on your customers and can help you increase your marketing ROI.

If you liked this blog post, you'll probably love Leadfeeder, too.

Sign up